Investing on behalf of a child can help with the child’s future. But before investing money for a child, it is important to understand who will be responsible for paying tax on the investment income and what tax rates might apply.

Benefits

Saving for a child can help to fund the cost of education or other life goals for the child to give them a good head start.

Understanding the tax implications of children’s investments can help you choose and structure an appropriate investment.

How it works

Investing on behalf of a child can be complex because a child often can’t hold an investment in their own name and penalty tax can apply to the investment income.

If money is invested for a child in a bank account, term deposit, managed fund or share, the owner of the investment will usually need to be a parent or guardian ‘as trustee’ for the child. The taxation of the investment income will largely depend on who is using the income from the investment.

If the trustee of the investment (i.e. the parent or guardian) is the source of the money and also uses the investment income, they will generally be deemed to be the owner and will be required to include the income in their tax return. Capital gains tax may apply if the trustee transfers the investment into the name of the child once they become an adult.

However, if the trustee reinvests the investment income for the future benefit of the child, then the child may be deemed to be the beneficial owner. In this situation, the child will pay tax on the income at penalty tax rates and capital gains tax may not apply when the investment is ultimately transferred into the name of the child.

Child penalty tax rates

Penalty tax rates apply to income earned by a child except in limited circumstances:

if the income is excepted income – which includes employment income or earnings on money inherited from a deceased person’s estate or family breakdown

if the child is an excepted person – which includes a child who is working full time or is married, permanently disabled or permanently blind.

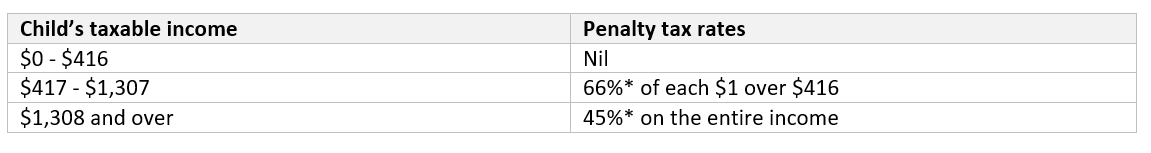

If applied, penalty tax rates are as per the following table:

* Medicare and other levies may also apply.

This means a child can only earn up to $416 in a year before all income is effectively taxed at the top marginal tax rate. This is to stop parents diverting income into a child’s name just for tax purposes.

Other investment options

Some investment bonds and education savings plans have been specifically designed for children and may be simpler to use for investing from a tax point of view. Both of these products are ‘tax paid’ investments, which means there are generally no tax implications for the child or the trustee.

The earnings within an Investment bond are taxed within the bond at the rate of 30%. After 10 years, the bond is considered to be fully tax paid and can be withdrawn without any tax implications to the investor.

Additional contributions can be made to the bond each year but if a contribution is more than 125% of the previous year’s contribution the 10 year period will recommence for the whole investment bond (the 125% rule).

An investment bond called a ‘Child Advancement Policy’ is held in the name of an adult on behalf of a child. The child must be under age 16 at the time of application and the adult can nominate the age that the investment converts to the child’s name as owner. If no date is nominated, the bond will usually transfer to the child upon turning age 25.

Education savings plan / scholarship plan are also tax paid investments with earnings taxed within the plan at the rate of 30%. This tax may be refunded if the money is ultimately used for the child’s education expenses, such as uniforms, travel costs, fees, books, living away from home allowance and residential boarding expenses. Withdrawals within the first 10 years may be taxable to the child, but tax offsets apply to reduce this tax.

Consequences

You should seek tax advice to confirm the tax treatment of child investments.

If you are a Centrelink customer and you make an investment on behalf of a child, you are required to let Centrelink know as it may impact your entitlement under gifting rules.

The decision on whose name to invest in also has implications for who has control over the money.

If investments are held in your name on behalf of a child or grandchild you may wish to seek legal advice to ensure that child inherits the money upon your death, or that another person is nominated as trustee to manage the money on the child’s behalf.

Date: 1 April 2018